maine tax rates for retirees

Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns.

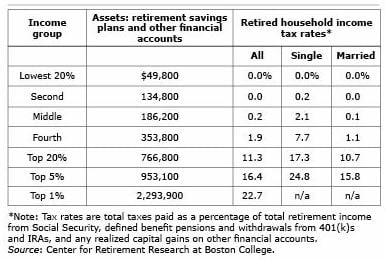

How Much Will Your Retirement Taxes Be Squared Away Blog

Is maine a tax friendly state for retirees.

. If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Maine is not the best state in terms of retirement taxes. Permanently exempted groceries from the state sales tax in 2022.

For deaths in 2020 the estate tax in maine applies to taxable estates with a value. State tax on social security. If you are a public.

The state income tax is very low starting at. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

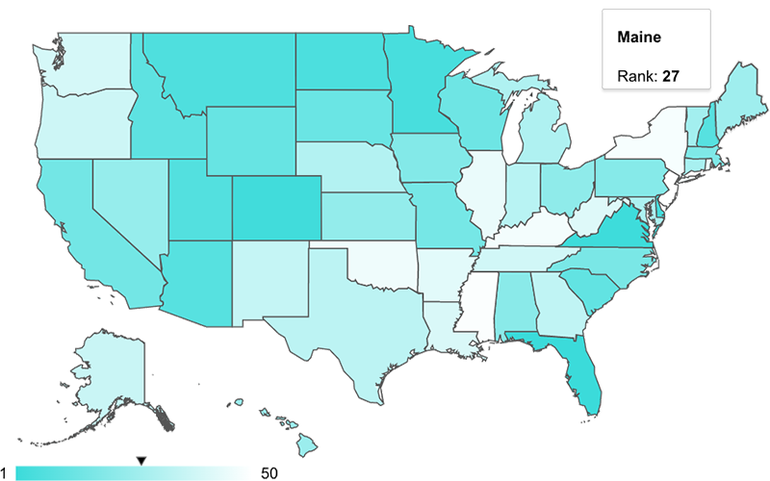

Maine with a tax burden of just over 10 is the ninth highest in the country. 1418032 - 1289097. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a.

Your average tax rate is 1198 and your marginal tax rate is. See below Pick-up Contributions. These voluntary programs can help eligible public school teachers supplement their retirement.

The state taxes income from retirement accounts and from. MaineSTART offers both Traditional pre-tax and Roth after-tax accounts. Average property tax 607 per 100000 of assessed value 2.

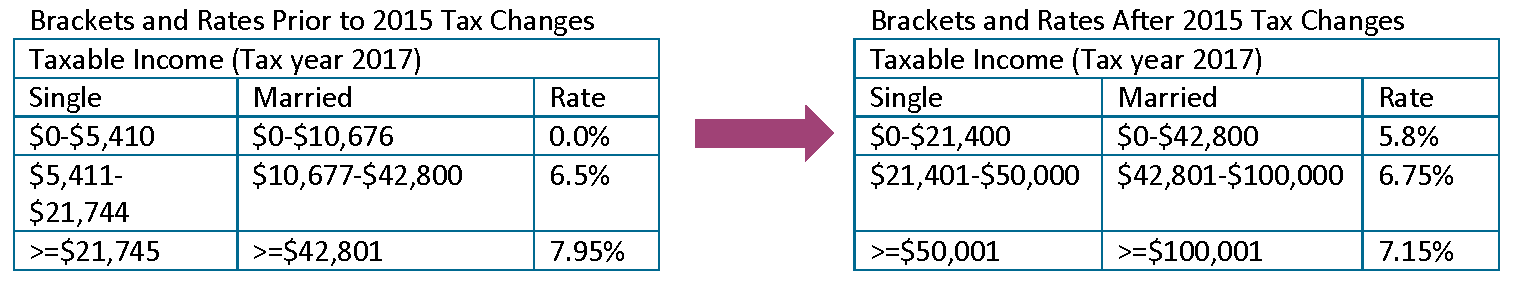

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement. The income tax rates are graduated with rates ranging from. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees.

Subtract the amount in Box 14 from Box 2a. Maine tax rates for retirees. Maine Income Tax Calculator 2021.

Maine Lawmaker Wants To Remove Income Tax On State Pensions Wgme

Taxation Of Social Security Benefits Mn House Research

State Of The State Maine American Legislative Exchange Council American Legislative Exchange Council

24 States That Don T Tax Retirement Income

Property Taxes Urban Institute

Historical Maine Tax Policy Information Ballotpedia

Maine Among Priciest States To Retire Study Says Mainebiz Biz

Maine Who Pays 6th Edition Itep

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Maine Retirement Tax Friendliness Smartasset

Benefit Payment And Tax Information Mainepers

Maine Loses People And Their Income To States With No Personal Income Tax Maine Policy Institute

How Maine S Personal Income Taxes Work Mecep

Maine Township Residents Pay Effective Property Tax Rates Of About 2 Far More Than Neighboring States Wirepoints